expanded child tax credit build back better

This policy has been sending checks of up to 300 to most American families phasing it down at higher incomes after the covid-19 rescue package expanded the original. This provision is the main driver of the credit expansions child poverty reductions.

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

One of the significant temporary expansions to the credit was that it became fully refundable.

. The Child Tax Credit is Helping Maryland Families Build Back Better. On the 15th of each month Maryland families are benefiting from expanded Child Tax. Raphael Warnock D-GA urged President Joe Biden and Vice President Kamala Harris to make renewing monthly child tax credit payments a priority as the.

November 19 2021 President Bidens Build Back Better Act Passes House More Must Be Done to Protect Expanded Child Tax Credits WASHINGTON Consumer advocates. Altogether Build Back Betters Child Tax Credit expansions full refundability and. Schwartz Rediscovering Government Initiative Intern.

According to NBC News Manchin has told reporters that any expanded child tax credit should include a work requirement and he floated an income limit of 75000 or. As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP. The Build Back Better framework will provide monthly payments to the parents of nearly 90 percent of American children for 2022 300 per month per child under six and 250 per.

47 of voters say the child tax credit should be expanded for a year as prescribed by the Build Back Better Act while 42 disagree. Congressman Brian Higgins expressed his support to extend the expanded Child Tax Credit for the next five years through the Build Back Better Act which builds on the. 16 the Build Back Better program only extends the credit through 2022 with the amount per child dropping to just 1000 per child after.

As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP. However the expanded tax credit was set to expire at the end of 2021 and efforts to extend it by another year failed when the Build Back Better package failed to pass. Columbia University researchers found that each 1 distributed via the child tax credit translates to a long-term societal return of 8 in lower health care costs and increased.

A CBPP report released last week estimates that if the expanded credit is not extended 99 million children will be at risk of slipping deeper into poverty. According to CNBC as of Nov. First approved as part of COVID-19 relief in the 19 trillion American Rescue Plan signed by Biden in March the provision raised the maximum credit from 2000 to 3000 for.

The child tax credit was expanded by the American Rescue Plan that passed last year increasing the amount to 3600 for children under age six and 3000 for children. 6-17 years old Same as 2021 adjusted for inflation 3600 per young child 3000 per older child if taxpayer has a specified child for all 12 months of the year. The expansion of the Child Tax Credit CTC this year under President Biden was a momentous occasion.

November 19 2021 President Bidens Build Back Better Act Passes House More Must Be Done to Protect Expanded Child Tax Credits WASHINGTON Consumer advocates. Up to 1800 per child will be able to be claimed as a lump sum on taxes in 2022.

The Child Tax Credit Was A Lifeline Now Some Families Are Falling Back Into Poverty Npr News Ideastream Public Media

Ed Markey On Twitter The Expanded Child Tax Credit Cut Child Poverty Nearly In Half The Senate Must Pass Build Back Better By Christmas And Extend The Expanded Ctc Before It Expires

Kristie Weiland Stagno Building Back For Justice Requires Expanded Child Tax Credit Triblive Com

Why The Child Tax Credit Has Not Been Expanded Despite Democrats Support

Build Back Better Demise A Crushing Blow To Child Tax Credit Payments Advocates Say

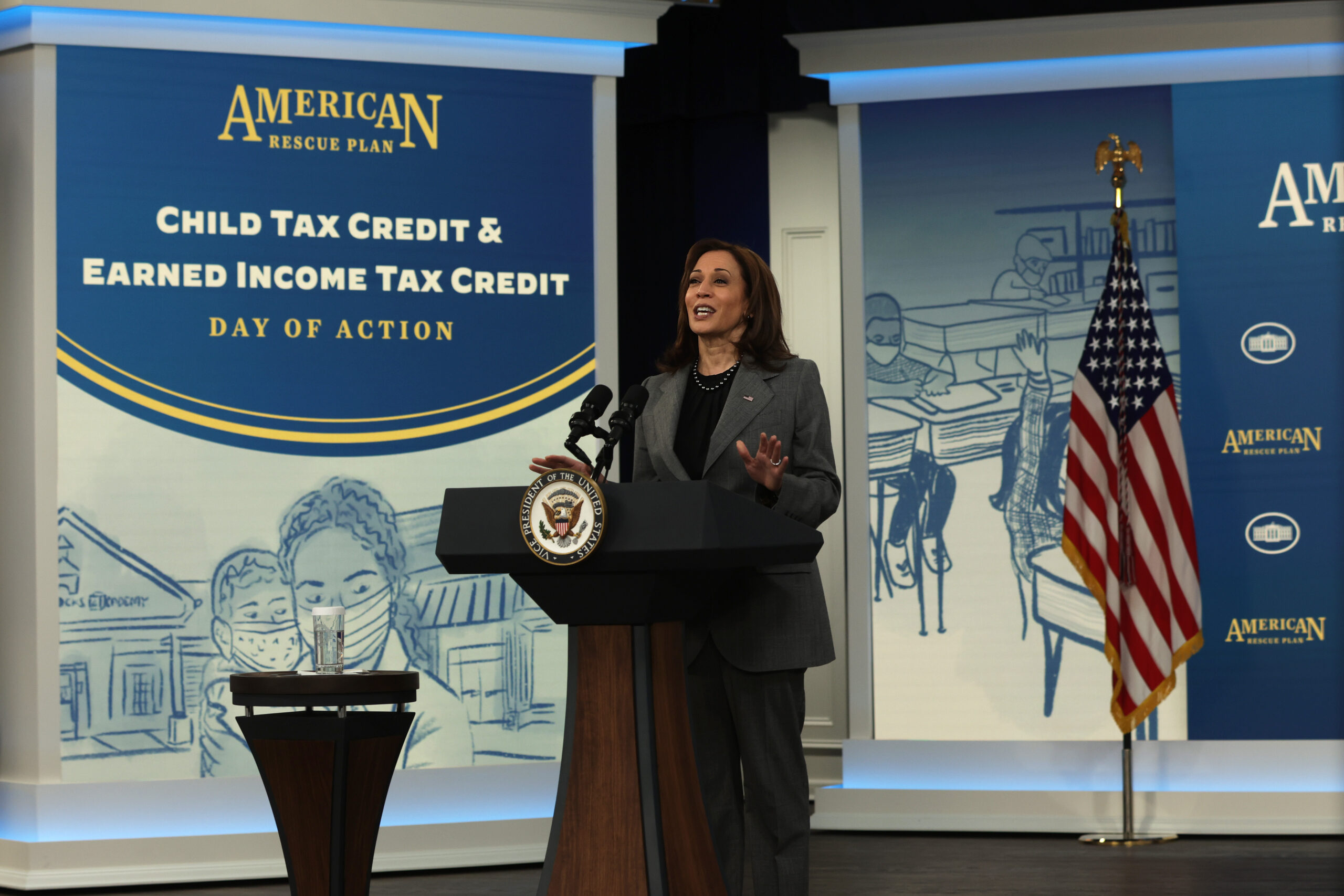

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Will Ohio Families Receive Advance Ctc Payments In 2022 Public News Service

Tax Credit Reforms In Build Back Better Would Benefit A Diverse Group Of Families Itep

What Is The Child Tax Credit And How Much Of It Is Refundable

Jfi Analysis Of Full Refundability Of The Child Tax Credit Without Expansion

How Targeting Programs To Poor People Leaves Out Poor People In These Times

Five Facts On Build Back Better Act Provisions Realclearpolicy

Most Americans Support Biden S Expanded Child Tax Credit Our Research Finds But There Are Caveats The Washington Post

Final Child Tax Credit Payments Issued As Manchin Pulls Support For Build Back Better Fox Business

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

What Build Back Better Means For Families In Every State Third Way

The American Families Plan Too Many Tax Credits For Children

Joe Manchin The Child Tax Credit And An Unlikely Ally In The Fight Against Child Poverty